/article-new/2018/09/1password2-800x515.jpg)

The price is going up to $65 new, no surprise there considering the state of Quicken on the Mac. Too bad for me that I do my finances on my iPad and iPhone most of the time, but I expect they make most of their money on the Mac. Customers will find no pixel left unturned and will be treated to over 100 changes and enhancements, like a new transaction editor with improved keyboard support, new reconciliation process, a new summary view, improved transaction downloads, more flexible budgeting, easier in-app navigation, redesigned reports and more. Google isn't throwing me ads about financial institutions either so it's meaningless to their data-mining efforts.īanktivity 6 is the biggest release in the history of the product. That's all I need for investments tracking and I don't care if anyone sees those numbers as they're not useful without the associated accounts.

So for that, I can access on desktop browsers or the Google Sheets app. But no way to determine which brokerages where they're actually held.

It shows I have 1000 shares of fund A, 1000 shares of fund B, 1000 shares of stock X, etc. But it's just a set of numbers, because they're not tied with account numbers or passwords at institutions. I do store the stock symbols and number of shares in my portfolio in a Google Sheets document, where prices are updated daily.

#BANKTIVITY SIDEBAR OPTION UPDATE#

In fact, my Intuit account which used to be able to access my accounts for Quicken Direct is no longer actively used, unless I buy a new version of Quicken than the Quicken Essentials I update manually. So no need for any kind of syncing at all. My point is, I don't have an overriding need to access my personal financial data from more than my Mac. It is somewhat more work than just importing transactions directly from your banks but it provides the data that I want and you pay attention to each transaction since you're entering each of them, rather than importing a 20 transactions you might have for some credit cards. Instead of just a general Travel category, I have separate categories for each trip and what I spend on air fares. This gives me more flexibility than Quicken or other programs because I can define the categories the way I want, so I can have as many sub-categories as I want. The template will total up spending for each category and chart it, so I can see how much I spend for the year in each category.

Besides the date and amount, you categorize each transaction like Mortgage, Utilities, Groceries, Entertainment, etc. I enter checking transactions and credit card transactions manually for each row. One of the templates that Numbers comes with is for a check register. I also have smaller spreadsheets to track DRIP transactions, to update my cost basis every day.Īnd then for budget tracking, I just use Numbers spreadsheets. So I can see the total change for my portfolio every day. So it's not a lot of work and QE still updates prices as long as I update the share quantities correctly.įor daily tracking, I have a Google Sheets spreadsheet with the same investments entered and use the GoogleFinance () function to update share prices, percent change, etc. Generally, most of my investments change the number of shares once a quarter or year.

#BANKTIVITY SIDEBAR OPTION DOWNLOAD#

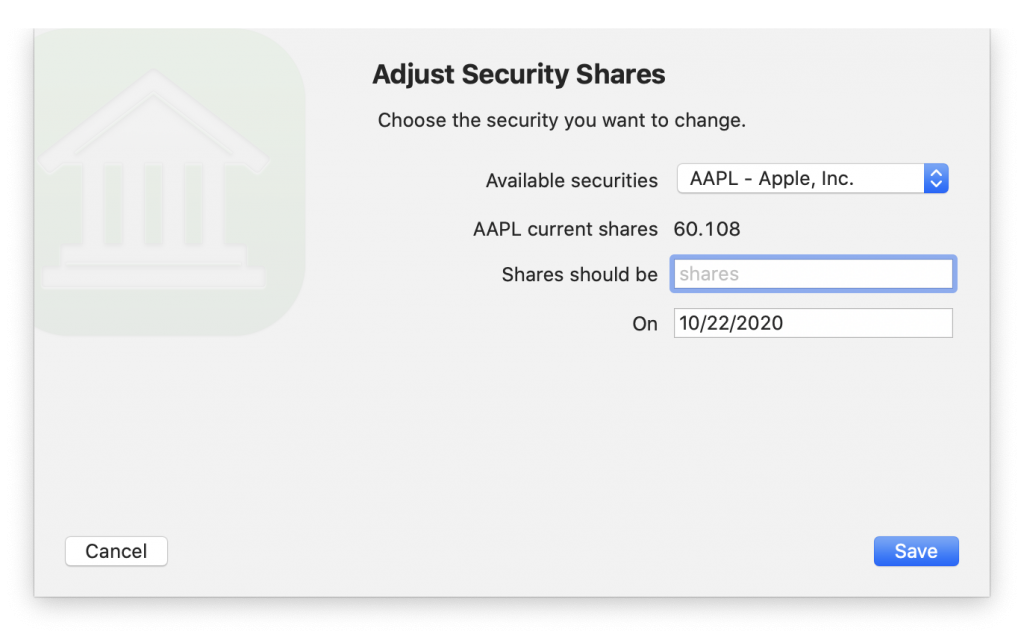

So that means I go and download several QFX files or manually update the number of shares if I have added or had DRIP transactions. I update this only once a month and I have a couple of dozen different investments across like 10 different institutions. QE no longer connects with my accounts so I deleted all the old Quicken Connect accounts I had originally set up and replaced them with manually-updated accounts. For investments, which I care more about than month-to-month budgeting, I use Quicken Essentials and Google Sheets.

0 kommentar(er)

0 kommentar(er)